Self-service testing and readiness, for frictionless on-boarding

Simo® for PSO

The Challenge for Payment Infrastructures

Around the world, major projects are under way to modernise RTGS and real-time payment platforms, based on ISO 20022.

Moreover, payments are moving towards a more constant, cyclical state of innovation with increasing complexity. Where payment infrastructures may have been refreshed every decade or more, in the future incremental changes will need to be supported far more regularly, alongside wholesale upgrades to keep up with the pace of changes in regulation and technology.

See the infographic: Payment System Modernization

- robust - stability key for critical infrastructure

- efficient - for better stakeholder experience, and

- scalable - to meet competitive demands and open to more parties

On-boarding with XMLdation

The Details - On-boarding with XMLdation

Value for Participants

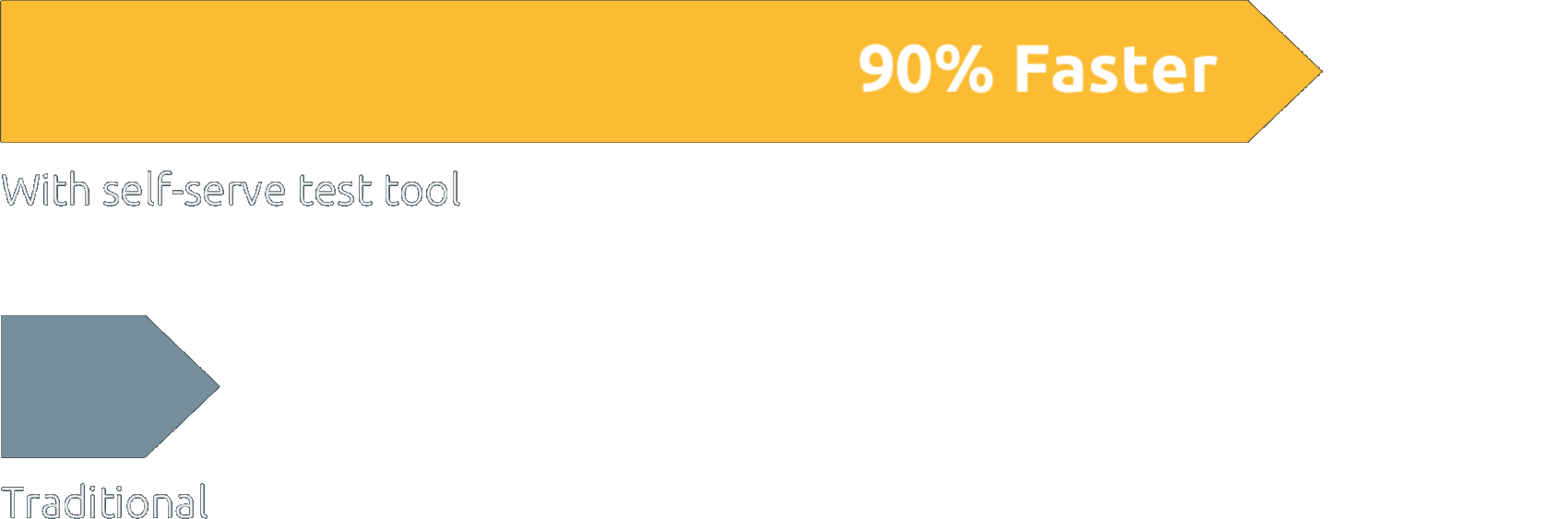

– get ready 90% faster

Using the Simulator, Participants do their own self-service testing, independently.

The self-service approach avoids the delays and scheduling challenges associated with partner testing, and resolves the myriad issues that cause unnecessary delays in go-live.

The Legacy Bridge can relieve pressure on participants who may need more time to adopt new messaging formats in their systems.

The value can be magnified for Participants by using the XMLdation solutions in a broader way as part of their own internal testing processes.

Value for payments clearing houses

Clearing houses can manage migration of their FIs efficiently, automate routine tasks in the testing phase, and allow their valuable internal technical resources to focus on the most complex implementation and testing tasks with the FIs.

Related

-

RBNZ introduce test automation for RTGS and CSD with XMLdation

Reserve Bank of New Zealand explains why they use XMLdation Simulator to address testing challenges during this period of considerable industry change.

-

XMLdation and Payments Canada – A Transformational Partnership

Sometimes it’s easy to pinpoint when a fruitful relationship starts. XMLdation has worked closely with Payments Canada for nearly five years, and it all.

-

Why is ISO 20022 important for Payment System Operators?

With the migration to ISO 20022 now in full swing, much has been written on the benefits for banks and their clients – but the voices of other market.